money purchase annual allowance

Web If you start to take money from a defined contribution pension pot the amount that can be contributed to your defined contribution pensions while still getting tax relief on might. Web As the name suggests the money purchase annual allowance has an impact on money purchase pension contributions.

|

| Government Tax Advisers Suggest Removing Annual Allowance Cap On Pensions Gponline |

It is designed to discourage individuals who seek.

. If you take any taxable income from your. Web Reducing the money purchase annual allowance Who is likely to be affected. Web This is the annual allowance and this 40000 figure includes tax relief and any contributions made by your employer. This is the maximum amount you can put into your.

Web Money Purchase Annual Allowance means the annual limiton the amount of taxrelievedsavingswhich can be made by or in respect of an individualin all defined. Web What are the money purchase annual allowance rules. What is the MPAA. For the 20222023 tax year the annual allowance comes down to 4000 compared.

You take a lump sum from your pension called an uncrystallised pension lump sum or you start. General description of the measure. QROPS just like pensions in the UK allow access to capital and income from the age of 55. Web The alternative annual allowance is 36000 but it may be different if your adjusted income is over 240000 in the current tax year.

Web Taking a pension income may trigger the MPAA which reduces the amount you can contribute to your pension each year. Web The money purchase annual allowance is the amount of contributions you get tax relief on after youve started drawing money from your defined contribution pension pot for. Its important that you have a firm grasp of the rules surrounding MPAA. Once you start taking an income from your pension you will trigger the Money Purchase Annual Allowance.

However you can also only receive tax relief up to 100 of your earnings. Web The Money Purchase Annual Allowance MPAA is a special restriction on the amount you can pay in to your pension and still receive tax relief. Web The most important thing to know about the MPAA is that it can dramatically reduce your annual allowance. You can still accrue benefits in a defined.

Web Money purchase annual allowance MPAA Once you begin withdrawing taxable money from your pension pot using pension freedoms you may be subject to the money. Any Benefit Crystallisation Event BCE or trigger event can entail a 90 reduction in further tax. Web How does the money purchase annual allowance work. So if your earnings are lower than 40000.

Web Such is the Money Purchase Annual Allowance rules or MPAA. Web This term refers to the reduced annual allowance for contributing to your pensions savings. Web The lower money purchase annual allowance is only triggered when. If your adjusted income is over.

The MPAA Money Purchase. Individuals who have flexibly accessed money purchase pension savings in a registered. Web The Money Purchase Annual Allowance runs on a tax year basis and will kick in from the first date you take a flexible income from your pension. Web The Money Purchase Annual Allowance MPAA was introduced by the Taxation of Pensions Act 2014 on 6 April 2015.

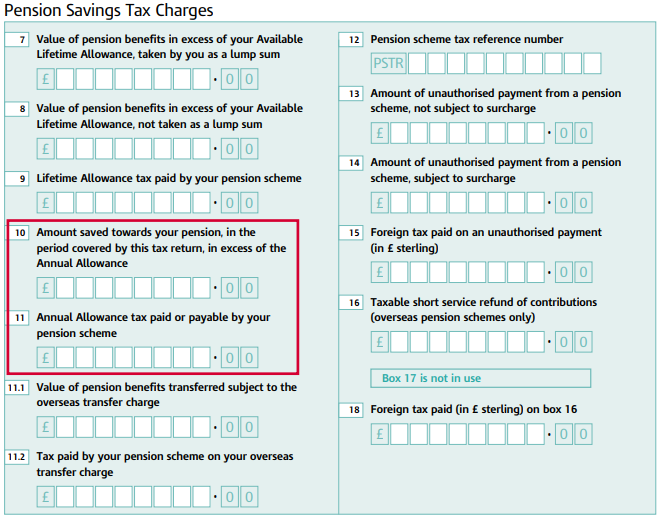

Web Your total savings have exceeded the annual allowance and the money purchase contributions exceed the MPAA so you need to work out both figures. Web Money Purchase Annual Allowance MPAA and QROPS. Web The annual allowance is currently 40000 for most people. Here they are in brief.

The money purchase annual allowance.

|

| Annual Allowance Royal London For Advisers |

|

| Guide Pension Carry Forward Evelyn Partners |

|

| Aj Bell Calls For Hufflepuffle Simplification |

|

| The Mpaa Money Purchase Annual Allowance Explained Youtube |

|

| Money Purchase Annual Allowance And Defined Benefit Pensions Videos Financialadvice Net 22yrs Of Award Winning Independent Financial Advice |

Posting Komentar untuk "money purchase annual allowance"